Navi app records 22x growth in UPI transactions over four months, doubling in July. Explore the implications for digital payments in India.

In a stunning display of growth, Sachin Bansal’s Navi app has achieved a remarkable 22x increase in Unified Payments Interface (UPI) transactions over the past four months, with a significant doubling of transactions in July alone. This surge not only highlights Navi’s rapid ascent in the competitive digital payments landscape but also underscores the broader trends in the adoption of cashless transactions in India.

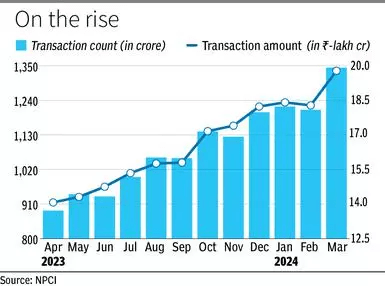

The digital payments ecosystem in India has seen explosive growth in recent years, with UPI emerging as a frontrunner in facilitating seamless transactions. Navi’s recent performance reflects a pivotal moment in this evolution, showcasing how fintech innovations can drive consumer engagement and transaction volume.

This article will delve into the factors behind Navi’s impressive growth, the implications for the UPI landscape, and what this means for consumers and businesses alike.

Table of Contents

Navi’s Growth Journey

Rapid Increase in UPI Transactions

Navi’s journey in the UPI space has been nothing short of extraordinary. The app recorded 68.5 million transactions in July 2024, up from 35.7 million in June. In March 2024, Navi’s UPI transactions were a mere 3 million, marking a staggering 22-fold increase in just four months.

- Transaction Value Growth:

- July: ₹3,600 crore

- June: ₹1,800 crore

- March: Less than ₹100 crore

This growth has propelled Navi from the 27th position in UPI rankings in March to the 6th position in July, closely trailing Amazon Pay, which recorded 72.4 million transactions in the same month.

Factors Driving Navi’s Growth

Several key factors have contributed to Navi’s phenomenal growth in UPI transactions:

- Incentives and Rewards: Since April 2024, Navi has introduced attractive rewards and cashback offers for UPI users. This strategy has successfully attracted new users and encouraged existing ones to increase their transaction frequency.

- User Experience: The Navi app is designed with a focus on user-friendliness, making it easy for users to navigate and complete transactions seamlessly.

- Marketing Strategies: Navi has effectively utilized digital marketing campaigns and partnerships to raise awareness about its UPI offerings, drawing in a broader user base.

- Trust and Security: Being an NPCI-approved platform, Navi ensures secure transactions, which is crucial for building consumer trust in digital payment applications.

The Competitive Landscape of UPI

Current Market Dynamics

The UPI market is highly competitive, with several established players dominating the space. The major competitors include:

- PhonePe: The market leader with a 48.3% share.

- Google Pay: Holding a 37% market share.

- Paytm: With approximately 7.8% of the market.

Despite Navi’s impressive growth, it currently holds only a 0.5% market share in the UPI ecosystem. However, its rapid ascent indicates that there is still room for new entrants to capture market share, especially those that can offer unique features and consumer incentives.

Challenges Ahead

While Navi’s growth trajectory is commendable, sustaining this momentum poses several challenges:

- Customer Retention: The primary challenge for Navi will be maintaining user engagement once the initial rewards diminish. Historical data suggests that many users may shift to other platforms once cashbacks are reduced, as seen with WhatsApp Pay’s initial success followed by a sharp decline in transactions.

- Market Saturation: With established players dominating the market, Navi will need to continuously innovate and enhance its offerings to keep pace with competitors.

The Future of UPI and Navi

Projections for UPI Growth

The UPI ecosystem is expected to continue its upward trajectory, with projections indicating that the number of UPI transactions could reach 10 billion per month by 2025. This growth will be driven by:

- Increased smartphone penetration across urban and rural areas.

- Expansion of internet access, particularly in underserved regions.

- Growing acceptance of digital payments among merchants and consumers.

read more: Share Trading Scam: Software Engineer Loses Rs 91 Lakh via Social Media Group

Navi’s Strategic Positioning

As Navi continues to refine its offerings and expand its user base, it is well-positioned to capitalize on the growing UPI market. The focus on user experience, security, and attractive rewards will likely play a crucial role in attracting new users and retaining existing ones.

Addressing Common Questions and Concerns

1. Is Navi UPI Safe?

Yes, Navi UPI is considered safe as it is regulated by the NPCI and follows stringent security protocols to protect user information and transactions.

2. How Do I Get Started with Navi UPI?

To start using Navi UPI, users need to download the Navi app, complete phone number verification, and link their bank account. The process is straightforward and user-friendly.

3. What Are the Benefits of Using Navi UPI?

- Instant money transfers

- Secure transactions

- Rewards and cashback on transactions

- Easy tracking of payment history

Conclusion

Navi’s remarkable 22x growth in UPI transactions over four months and the doubling of transactions in July underscore the dynamic nature of the digital payments landscape in India. As consumers increasingly embrace digital payment solutions, Navi’s success highlights the importance of user-centric design, security, and incentives in driving engagement.

While the competitive landscape poses challenges, Navi’s innovative approach and strategic initiatives position it well for future growth. As the UPI ecosystem continues to evolve, it will be fascinating to see how Navi and other players adapt to changing market dynamics and consumer preferences.

Discover more from RVCJ News Media

Subscribe to get the latest posts sent to your email.

2 thoughts on “Navi App Records 22x Growth in UPI Transactions Over 4 Months, Doubles in July”