RBI raises UPI transaction limit to Rs 5 lakhs for tax payments, enhancing digital payment convenience. Discover the implications and benefits of this update.

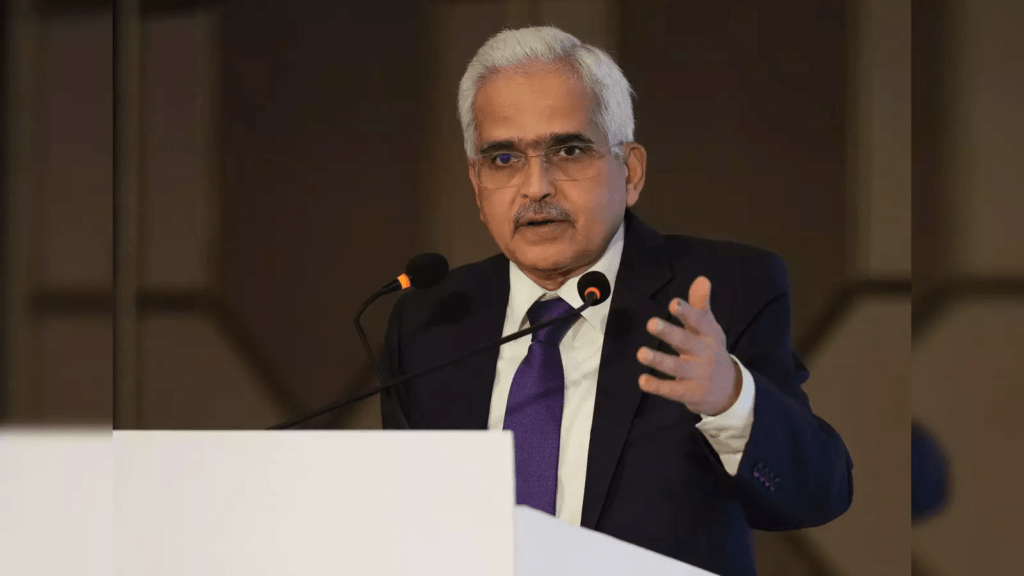

In a significant move to enhance digital payment capabilities in India, the Reserve Bank of India (RBI) has announced an increase in the Unified Payments Interface (UPI) transaction limit for tax payments from Rs 1 lakh to Rs 5 lakhs. This policy update, which was revealed during the recent Monetary Policy Committee meeting, aims to facilitate smoother high-value transactions and promote the use of digital payments among taxpayers. As UPI continues to gain traction as a preferred payment method, this change is poised to have far-reaching implications for individuals and businesses alike.

Picture this: you’re at the brink of a tax payment deadline, and the thought of making a large transaction fills you with dread. The hassle of navigating through multiple payment options often leads to frustration. However, with the RBI’s latest update, making high-value tax payments through UPI has become significantly easier. The increased transaction limit is not just a number; it represents a shift towards a more efficient and user-friendly digital payment ecosystem.

The importance of this update cannot be overstated. As India moves towards a cashless economy, simplifying the payment process for high-value transactions is crucial. This article delves into the details of the RBI’s decision, its implications for taxpayers, and the broader impact on the digital payment landscape in India.

Understanding UPI and Its Significance

What is UPI?

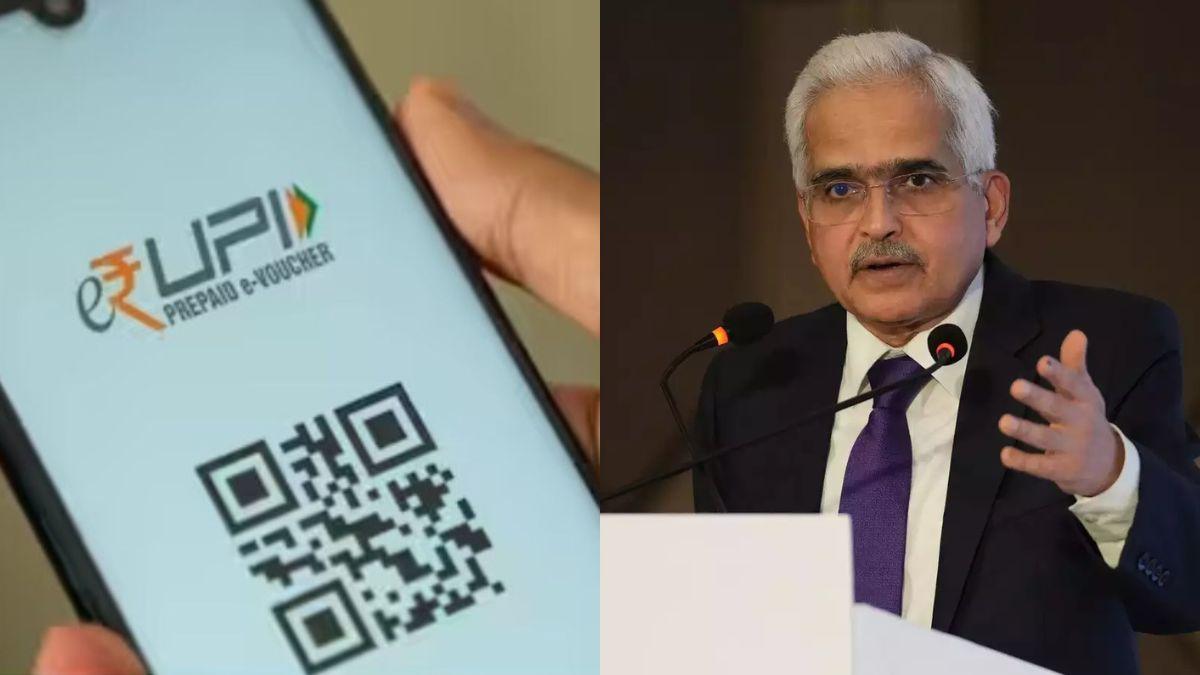

The Unified Payments Interface (UPI) is a real-time payment system developed by the National Payments Corporation of India (NPCI) that facilitates instant money transfers between bank accounts through mobile devices. Launched in 2016, UPI has revolutionized the way people conduct transactions in India, offering a seamless and secure method for transferring money.

Why UPI Matters

- Convenience: UPI allows users to make payments 24/7, eliminating the need for cash or physical cards.

- Speed: Transactions are completed in real-time, making it ideal for urgent payments.

- Integration: UPI is integrated with various banking apps and third-party applications, enhancing accessibility.

- Cost-Effective: UPI transactions are generally free or have minimal charges, making it an economical choice for users.

The RBI’s Decision: Key Highlights

Increased Transaction Limit

The RBI’s decision to raise the UPI transaction limit for tax payments from Rs 1 lakh to Rs 5 lakhs is a significant step forward. This change aims to:

- Facilitate High-Value Transactions: Tax payments often involve substantial amounts, and the previous limit was a constraint for many taxpayers. The new limit allows for easier handling of these payments.

- Encourage Digital Adoption: By simplifying high-value transactions, the RBI hopes to encourage more individuals and businesses to adopt digital payment methods.

- Boost Tax Compliance: With easier payment options, taxpayers may be more inclined to meet their tax obligations promptly.

Delegated Payments Feature

In addition to increasing the transaction limit, the RBI has proposed a new feature called “delegated payments.” This feature allows a primary user to set a transaction limit for another individual (secondary user) using the primary user’s bank account. This is particularly useful for:

- Family Transactions: Family members can manage payments on behalf of each other without needing separate UPI accounts.

- Business Operations: Businesses can streamline payments by allowing employees to make transactions within a specified limit.

- Enhanced Security: The primary user retains control over the account while granting limited access to others.

read more: 5 Key Things to Consider Before Investing in Stocks

Implications of the Policy Update

Impact on Taxpayers

The increase in the UPI transaction limit is expected to have several positive effects on taxpayers:

- Simplicity and Efficiency: Taxpayers will find it easier to make large payments without the need to split transactions or use multiple payment methods.

- Reduced Frustration: The hassle of dealing with payment gateways and potential transaction failures will be minimized.

- Increased Usage of UPI: As more taxpayers use UPI for their transactions, the overall adoption of digital payments is likely to rise.

Impact on Businesses

For businesses, especially those dealing with high-value transactions, this policy update presents several advantages:

- Streamlined Payment Processes: Businesses can manage tax payments more efficiently, reducing administrative burdens.

- Improved Cash Flow Management: With the ability to make larger payments quickly, businesses can better manage their cash flow.

- Encouragement of Digital Transactions: As businesses adopt UPI for tax payments, they may also begin to accept UPI for customer transactions, further promoting digital payments.

Addressing Common Questions and Concerns

1. How will this change affect small businesses?

Small businesses that often face challenges with cash flow will benefit from the increased transaction limit. They can manage their tax payments more effectively without worrying about transaction limits.

2. Will there be any additional charges for higher transactions?

While UPI transactions are generally free, users should check with their respective banks for any specific charges that may apply to high-value transactions.

3. How can I set up delegated payments?

The RBI will issue detailed instructions on how to utilize the delegated payments feature once it is rolled out. Users will need to follow the guidelines provided by their banks or UPI service providers.

4. Is UPI safe for high-value transactions?

Yes, UPI is designed with security in mind. It employs multiple layers of security, including two-factor authentication, to ensure safe transactions.

Conclusion

The RBI’s decision to raise the UPI transaction limit for tax payments to Rs 5 lakhs is a landmark move that simplifies the payment process for taxpayers and businesses alike. By facilitating high-value transactions and introducing delegated payments, the RBI is not only enhancing the user experience but also promoting the adoption of digital payments across India.

As the country continues to embrace digitalization, this policy update represents a significant step towards a more efficient and user-friendly financial ecosystem. For taxpayers, this means greater convenience and ease in fulfilling their obligations, while businesses can benefit from streamlined operations and improved cash flow management.

In summary, the increase in UPI transaction limits is a positive development that aligns with India’s vision of becoming a cashless economy. As we move forward, it will be interesting to see how this change influences the landscape of digital payments and tax compliance in the country.

Discover more from RVCJ News Media

Subscribe to get the latest posts sent to your email.

1 thought on “RBI Policy : UPI Transaction Limit Raised to Rs 5 Lakhs”